Lesson 4: Technical Analysis Basics

You'll Learn: How to read price charts like professional traders

Understanding Chart Types

Line Chart

Shows closing prices connected in a single line

Candlestick Chart

Visualizes open, high, low, and close prices

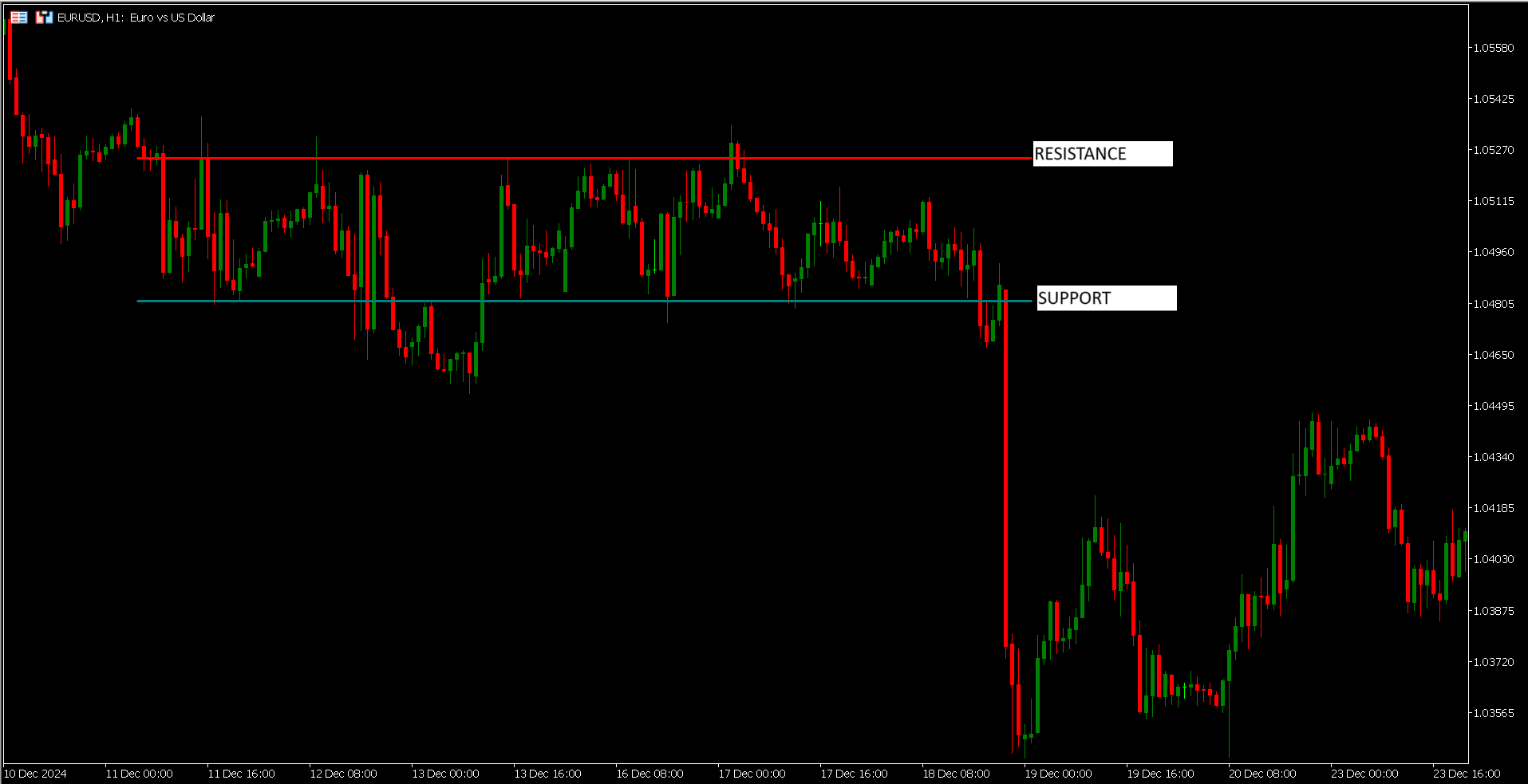

Support & Resistance Zones

What Are Support & Resistance?

- Support: Price level where buying interest is strong enough to prevent further decline

- Resistance: Price level where selling pressure is strong enough to prevent further rise

- These levels form because traders remember where prices reversed previously

Support Level

1.04805

1.04805

Resistance Level

1.05265

1.05265

Key Characteristics:

Strength Factors

- More touches = stronger level

- Longer timeframes = more significant

- Volume spikes confirm validity

Real Market Example

EUR/USD bounced 3+ times at 1.04805 support

Think of support/resistance like a basketball court - price bounces between floor (support) and ceiling (resistance)

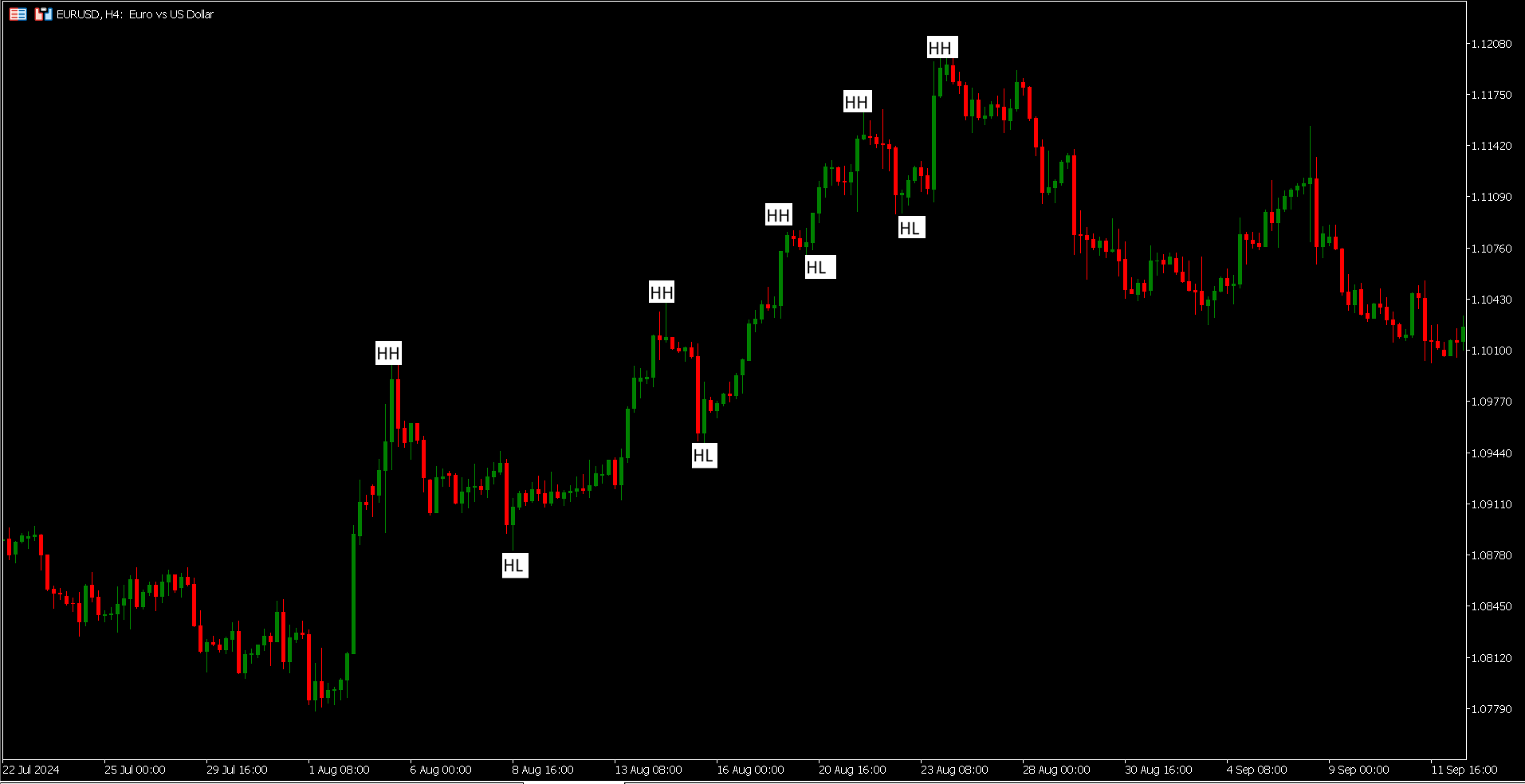

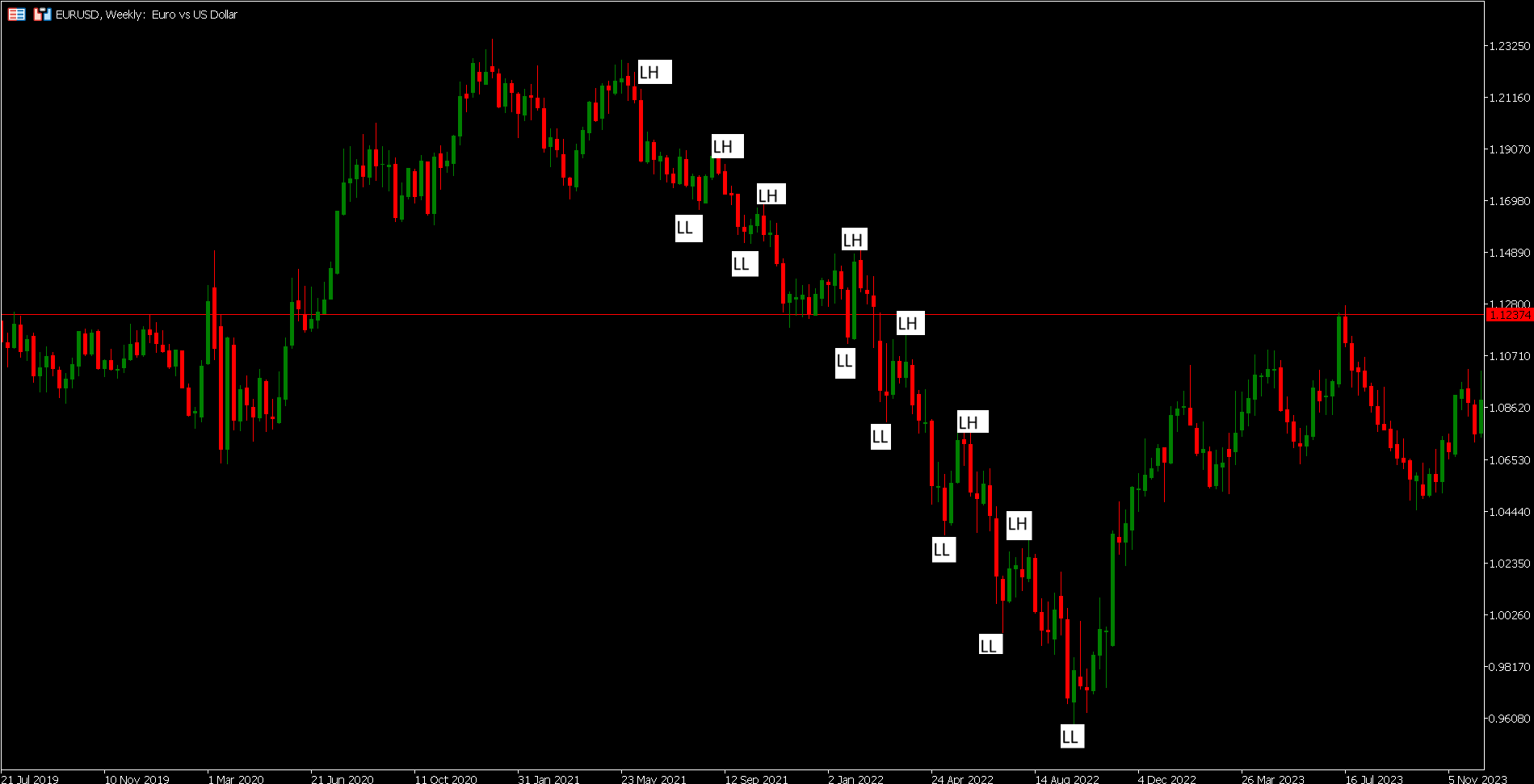

Identifying Trends

What Makes a Trend?

- Uptrend: Series of higher highs (HH) and higher lows (HL)

- Downtrend: Series of lower highs (LH) and lower lows (LL)

- Sideways: Price moves between horizontal support/resistance

Uptrend Features

- Price stays above rising trendline

- Moving averages slope upward

- Bullish chart patterns (cup & handle, flags)

Downtrend Features

- Price stays below descending trendline

- Moving averages slope downward

- Bearish chart patterns (head & shoulders, triangles)

Pro Trading Tips:

Trends exist in all timeframes - daily trends are stronger than hourly

Average trend duration: 3-6 months for major currencies

Key Indicators

Moving Averages (MA)

Types of MA

- SMA: Simple MA (average closing prices)

- EMA: Exponential MA (weights recent prices more)

Common Uses

- 50 & 200 MA crossover signals trend changes

- Price above MA = uptrend confirmation

- Dynamic support/resistance levels

Current Chart: 200 SMA (green) acts as resistance, 50 EMA (red) acts as support

Relative Strength Index (RSI)

Key Levels

- Overbought: Above 70

- Oversold: Below 30

- Divergence signals reversals

Calculation

RSI = 100 - (100 / (1 + Average Gain / Average Loss))

Typically calculated over 14 periods

Current Chart: RSI bouncing from 30 indicates potential bullish reversal

Remember: Indicators lag price action - always confirm with price patterns!