Advanced Technical Analysis

You'll Master: Candlestick Patterns, Chart Formations, and Fibonacci Retracements

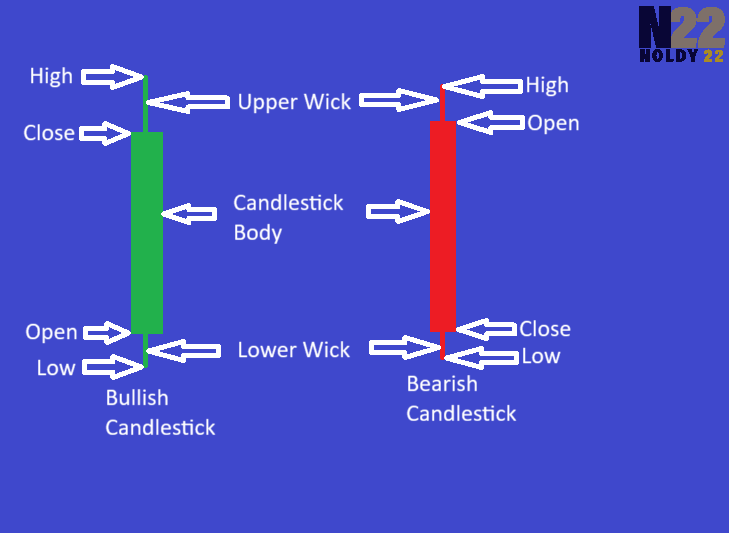

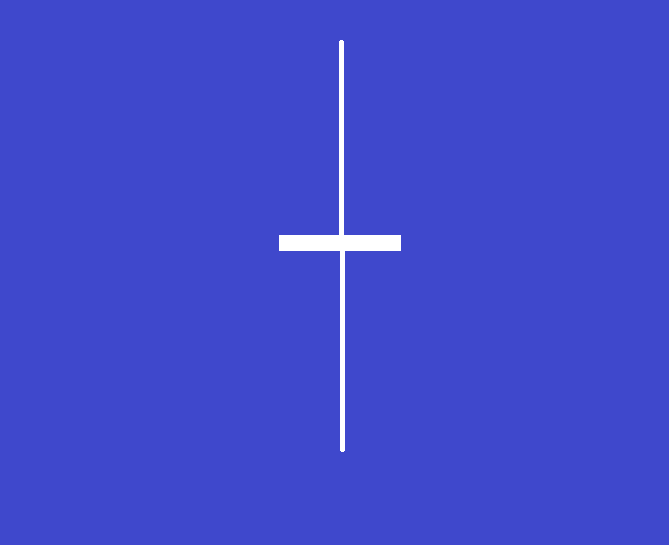

Candlestick Anatomy

Price Blueprint:

Each candle tells the market story through its body and wicks

Key Components:

- Body: Open to Close price

- Upper Wick: High price

- Lower Wick: Low price

- Color: Green (Price Up) / Red (Price Down)

Colors may vary based on the settings of the trading app/platform that you are using

Candlestick Patterns Explained

Market Sign Language:

Patterns are the market's way of showing its next potential move

Three Main Pattern Types:

Bullish Patterns (Prices Likely Rise)

Hammer Pattern

Like hitting bottom - sellers try to push down but buyers hammer the price back up

- Small body at top

- Long lower wick

- Appears in downtrend

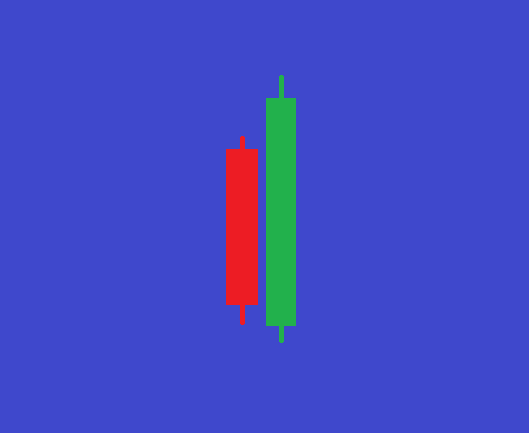

Bullish Engulfing

Like sunrise after dark - buyers completely overpower previous sellers

- Green candle swallows red candle

- Closes above previous open

- Big volume preferred

Bearish Patterns (Prices Likely Fall)

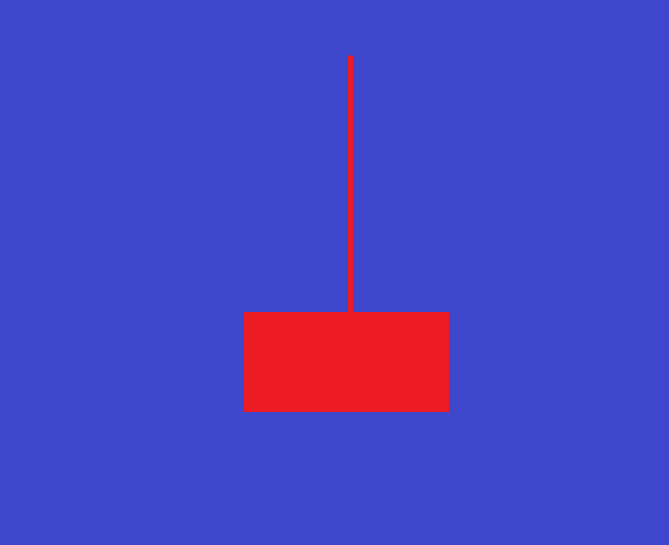

Shooting Star

Like a failed rocket - buyers try to push up but crash back down

- Small body at bottom

- Long upper wick

- Appears in uptrend

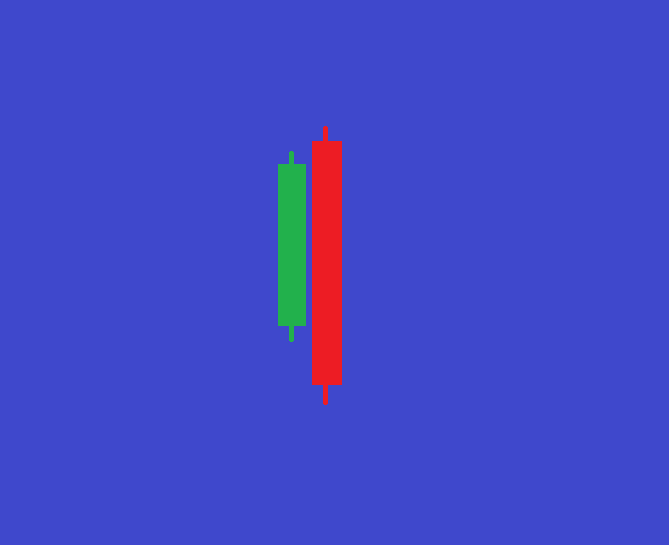

Bearish Engulfing

Like storm clouds covering sun - sellers overwhelm previous buyers

- Red candle swallows green candle

- Closes below previous open

- Big volume preferred

Neutral Patterns (Market Hesitation)

Doji

Tug-of-war tie - buyers and sellers equally matched

- Very small body

- Long wicks both sides

- Needs confirmation

Real Market Example

After two red candles, hammer forms → Price reverses upward!

Chart Formations Decoded

Common Patterns:

1. Head & Shoulders

What it Means: Signals trend reversal after three peaks (left shoulder, head, right shoulder)

2. Double Top/Bottom

What it Means: Two failed attempts to break price levels indicate potential reversal

3. Triangle Patterns

Ascending Triangle

(Bullish Continuation)

Descending Triangle

(Bearish Continuation)

Look for these two and more chart patterns as your assignment

Fibonacci Magic

What is Fibonacci Retracement?

A tool using mathematical ratios (23.6%, 38.2%, 50%, 61.8%, 78.6%) to predict support/resistance levels

How Traders Use It:

Identify recent major price swing (high to low)

Draw Fibonacci levels between these points

Watch for price reactions at key levels

The best key level is 61.8

Live Example:

Practice Zone